#50 - The Hidden Estate Tax Traps Families Overlook

Reluctant Executor News

Do you have to worry about paying taxes after you die? Well, you don't, but your heirs might.

When most people hear about estate taxes, they also hear that only large estates are taxed. In 2026, families will not owe estate taxes unless it's valued over $15 million, or over $30 million for married couples. The majority of families in the US don't have to worry about this… but that is only for federal taxes.

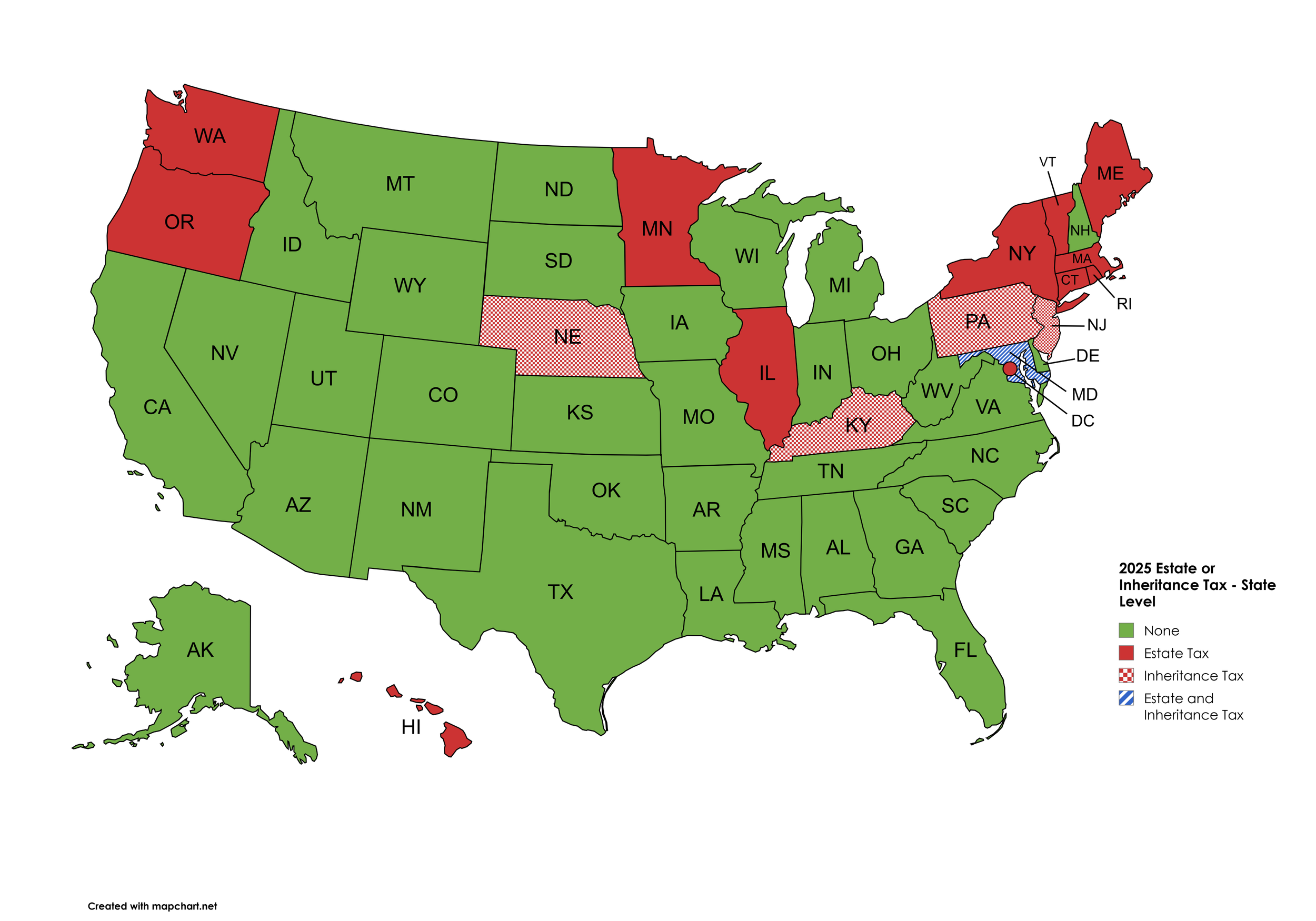

If you live in one of the lucky states that implements an estate or inheritance tax, then you will have to check the state specific estate tax requirements. The states shaded on this map show if they have an estate or inheritance tax. In the case of Maryland, they have both.

What is the difference between inheritance and estate taxes?

The main difference between inheritance and estate taxes is who pays it. An inheritance tax is paid by the recipient of the assets, based on the value of the assets received. An estate tax is paid by the estate, based on the value of the estate.

Keep in mind that the tax is based on the state that the deceased was a resident of. If you live in a state without any tax and you inherit property from an estate with an inheritance tax, you'll owe money to that state.

Each state that has an estate or inheritance tax is different. They have different exemption amounts, different rates, and in some cases different rates depending on your relation to the deceased. For example, Pennsylvania imposes no inheritance tax for surviving spouses or to a child 21 or younger. But if that child is older than 21, or the beneficiaries are siblings, friends, or even charities, the rate ranges between 4.5%-15%.

Why is this important?

A common strategy to avoid probate is to designate assets as Payable on Death (POD) or Transferable on Death (TOD). Doing this will transfer assets directly to the named beneficiary, bypassing the need for an estate account. However, most of the time these assets still need to be included in the total estate valuation, which is what the estate tax is based on. If the executor does not have enough money in the estate account to pay taxes, what do they do?

One option is to try to recover the money from the beneficiaries. Depending on the family dynamics, this could be easy or difficult. A better option is to plan ahead and leave enough money in a way that is easily accessible for the executor to pay the required taxes. As always, make sure you talk to your tax or legal advisor for details specific to your situation.

Estate Organization

Did you read this article and ask yourself, "I wonder if my accounts have a TOD?" or "I live in one of the shaded states, how will estate or inheritance tax impact me?" If so, you've taken a step toward estate planning. Specifically, you recognized that there are things you need to figure out.

When you're ready to figure this out and dive into other areas of estate organization, schedule a call with us.